Paul Benson, CEO of junior Australian gold mining company, Troy Resources, talks to Gay Sutton about the challenges and rewards of low cost gold production.

There are not many gold mining companies, large or small, that have been able to deliver cash dividends to their shareholders 12 times over the last 12 years. Australia-based Troy Resources has not only achieved this, but continued to do so during 2008 when the world slipped into global recession. So what is the secret behind this impressive track record?

“We have built our reputation on acquiring high grade deposits that others have turned their backs on because they believed there weren’t enough reserves and contained ounces to justify the CAPEX required to bring it into production,” explained CEO Paul Benson. “In each case we’ve been able to significantly lower the mine development costs, turning the project from unattractive to attractive. The real profit then came from adding more ounces through successful exploration. We’ve been very good at doing that.”

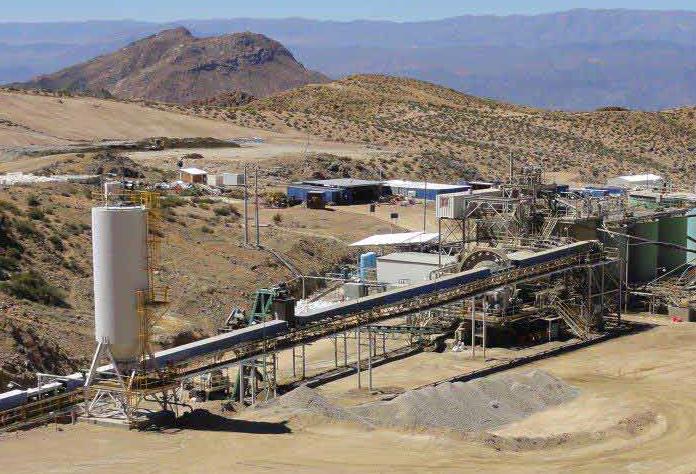

The recently opened Casposo mine in Argentina, which went into production in 2010, is an excellent example of this. “The previous owners had done a feasibility study and assumed the capital requirement would be about $86.5 million,” Benson said. “We built it for $45 million, saving over $40 million.” Certainly, it’s an impressive result when compared to the cost over runs that are common in the industry. Exploration last year then increased the mine’s resources by in impressive 20 percent, further improving its profitability and prospects.

Launched on the ASX in 1987 as an exploration company, Troy migrated to mining in 2000 when it began pouring gold at what turned out to be a highly productive mine - Sandstone in Western Australia. Continuously scanning the market for new opportunities, the company quickly expanded into South America and has established a good track record of bringing successful mines into production. Today, dual listed on the Australian and Canadian stock markets, the company has two active mines, both of them in South America.

The smaller and older of the two mines is Andorinhas in Brazil. Opened in 2008, it produces 50,000 ounces of gold per year with a current mine life to 2015. Initially, however, there were some challenges. “When we went underground in 2009 we struggled to achieve the production we expected. The ore body was low-grade at the top and relatively thin, but we knew it would improve as we went deeper,” Benson said. “We made a few changes in our mining method, and our output improved from 31,000 to 49,000 ounces in FY 2011 while the cash costs have fallen from $630 to $590 an ounce.” Benson also believes there is the potential to extend the mine life for another two years, and is investing some $1 million in exploration for 2012.

The larger mine in the Troy portfolio is Casposo in Argentina. Impressively, this was developed in just one year and began pouring gold in November 2010. The dore it produces is approximately 92 percent silver by volume and 7 percent gold, but the gold accounts for 80 percent of the mine’s revenue. Once in full production, the site is expected to produce 100,000 ounces of gold equivalent a year.

Casposo, however, has been a technically interesting project and the increase to full production has been delayed. Not only has the complexity of the process been increased by the addition of a Merrill Crowe circuit to recover the silver present in the ore, but the seismically active nature of the region has presented additional challenges.

Before construction started, Troy worked closely with the University of San Juan to establish the most suitable materials and construction techniques for earthquake-proofing the processing plant. “The original mine permit also required us to build a dry tailings facility because of the seismicity of the area. The theory behind this is quite simple, but making it work in practice has been more of a black art than a science. So although we poured first gold in November 2010 it wasn’t until March 2011 that we got this part of the process working efficiently,” Benson said.

“Then, just as we thought we were home and dry and were almost patting ourselves on the back, we were hit by the worst winter in Argentina in 50 years,” he continued. Normally lying 300m below the snowline, Andorinhas found itself 300m above it last year, and temperatures remained persistently below -9oC. Everything froze. “It was as though the gods were playing games. It came through on rolling fronts every two weeks and just as we’d defrosted the site the freeze would come through again, impacting production significantly between July and September.”

Casposo is now ramping up towards full production. And the three months to December give some indication of what the mine will eventually be capable of – 20,700 ounces of gold in three months at a cash cost of just $270 an ounce net of silver credits is very low cost gold.

The future for Casposo also looks very bright. Low sulphidation epithermal deposits such as this don’t usually occur in isolation, and across the Troy concession there are a large number of gold-bearing veins breaking the surface. Of course their quality and content cannot be confirmed until the drilling has been completed, but last year’s exploration program increased the mine’s gold resources by 20 percent, all of it in the high grade bracket. With much still to do, the exploration budget for 2012 has been doubled to $15 million. “We have enough known targets showing anomalous gold to keep us busy for the next three years, so I believe there’s a high probability that we will be mining here for more than 10 years,” he said.

Low-cost mine development is the foundation of the Troy business model, and has two central elements: the use of second hand processing equipment where suitable, and project managing the mine construction in house. “We have a small but very experienced team and the same person has been in charge of constructing all our mines,” Benson explained. “We then subcontract elements of the work to local suppliers.” This works particularly well in South America where there is a long tradition of mining and a very skilled professional and technical workforce readily available. This then also benefits the local communities who can share in the wealth generated by the mines.

Troy’s first mine in South America was equipped with a second hand processing plant acquired in Australia. “When that first mine closed we then moved the plant 1000 km north to Andorinhas, reducing development costs to just $19 million.” Casposo has also turned out to be suitable for a processing plant that had been acquired in Australia in 2001 and mothballed as an investment for the future. “We dismantled it and shipped it to Argentina. That alone has saved us about $20 million in development costs,” Benson said.

Looking to the future, Troy is not only continuing its search for new prospects to develop, but is also investing in basic geological research, funding PhD work at the Centre for Exploration Targeting at the University of Western Australia and the University of San Juan in Argentina. This benefits both parties. Troy has access to high level technical skills and resources and the universities benefit through secured funding for their PhD students, and exposure to the mining industry.

“The trick with exploration and development is that you’ve got to be smart – and although they don’t teach this in business school you’ve got to be lucky,” Benson concluded. “We have the right people to be smart, and we’ve been lucky so far. So we hope that continues.”

In many ways companies can make their own luck, simply by ensuring they have created the right conditions for it to occur, and Troy Resources seems to be doing all it can to set the scene.

DOWNLOAD

Troy.Resources-AM-Bro-s.pdf

Troy.Resources-AM-Bro-s.pdf